Legendary finance guru George Hara told told a somewhat stunned business community that if Hong Kong can rid itself of short-term thinking, it stands to become “a model city”. James Ockenden was there.

HONG KONG NEEDS to stop chasing short-term returns and shift to “public interest capitalism” to thrive as a tech centre, one of the world’s top venture capitalists told an audience of business folk, entrepreneurs and university heads in a packed Taikoo Shing conference hall this week.

Ambassador George Hara, Group Chairman and CEO of DEFTA Partners, a man with dozens of unicorns under his belt and former special advisor to the Japanese government, was speaking at an Our Hong Kong Foundation Insights event, where he claimed that the traditional way to measure technology and research success was flawed.

As Hara pointed out, most firms use internal rate of return (IRR) in the beauty contest of project selection and technology investment.

I don’t care about short-term shareholders, because they don’t contribute.”

George Hara

“High IRR is a good thing in finance,” he says. “But if we want to make new industries, this is not enough. When IRR is the measure of success, the company will never invest in long-term research projects. The Hong Kong government should not choose [projects with] good IRR,” Hara said. “It’s a mistake.”

Not only should our city throw out traditional metrics like IRR but corporations should shift away from pandering to short-term investors.

“I don’t care about short-term shareholders, because they don’t contribute,” said Hara, triggering nervous sideways glances from audience, half of whom had still-warm equity trading apps on their phones. Had they stumbled into some sort of cult meeting? Would they be asked to throw their wallets away for Jesus?

PUBLIC INTEREST CAPITALISM

If Hara’s public interest capitalism sounds wild in capital-crazy Hong Kong, he’s used to that reaction: in fact, these concepts, while not new, have been under attack by shareholders since the birth of the production line.

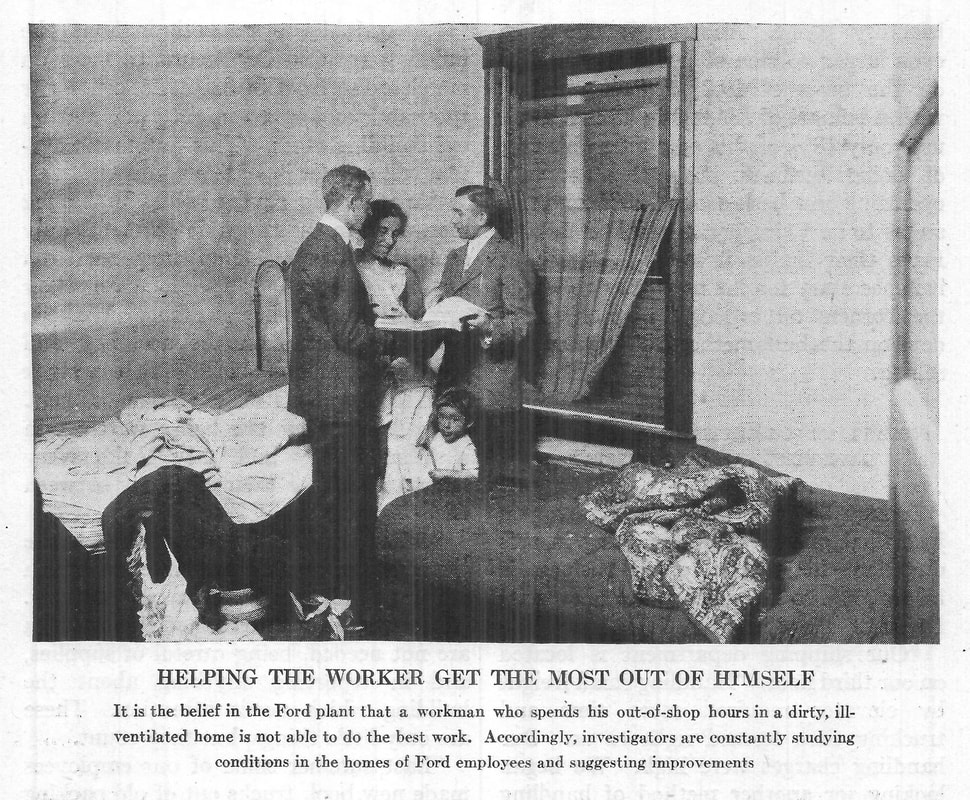

Take Henry Ford who, in 1916, awash with cash after the runaway success of his nifty Model T, decided to cut shareholder dividends to do good: build new plant, lower prices and raise wages.

Ford was instantly sued by shareholders: the firm’s business was making cars, not charity, they said (paying staff above market rates was, and probably still is, viewed as charity). The case went all the way to the US Supreme Court, whose landmark decision held that businesses, ultimately, worship only at the altar of shareholder wealth.

BOEING, MCDONALD’S, ‘WILL DIE‘

And not much has changed in public listed companies over the last century, for all the well-meaning folk who have tried to make a business case for “doing good”.

As such, Hara doesn’t invest in existing companies, claiming it’s difficult to change culture once a company is up and running.

He pointed to examples including GE, Boeing, Cisco and McDonalds, which continue to distribute multiples of their profits to shareholders. “These companies will die,” he says boldly. “They are not investing in the future”.

My aim is not capital gain or exit, it’s to build a well-educated, healthy middle-class”

George Hara

The former UN ambassador is an interesting fellow who spent his formative years as an archaeologist tracking down ancient Mayan migration routes in Central America before deciding he needed to earn some money and signing up for business school at Stanford University. He quickly shifted to an engineering focus and, something of a star student, built the world’s first fibre-optic display company in 1981.

“Always my aim is not capital gain or exit, it’s to build a well-educated, healthy middle-class,” he told the packed seminar. “Profit is never my objective.”

Profit and shareholder value come nevertheless, and Hara’s portfolio is living proof of his “public good” concept.

DEFTA Partners’ businesses include exhibition giant TradeX, Zoom-predecessor PictureTel, firewall inventor Fortinet and Japanese biotech firm CUORiPs which grows beating heart tissue and is transforming treatment of heart failure.

These firms and many more were built on three foundational pillars: fair distribution of profits, no short-term thinking and a strong sense of innovation.

STAMPING OUT SHORT-TERM THINKING

Aside from practicing what he preaches, Hara is a fierce advocate for changes in corporate law which would support Public Interest Capitalism in other companies. For example, he’s been a powerful voice behind Japan’s legal end to corporate quarterly reporting: from April this year, listed firms will quit churning out first- and third-quarter reports.

That’s something tech mogul Elon Musk, as just one example, would appreciate: Musk has publicly said that quarterly reporting for his listed SpaceX might “actually result in a less efficient operation where you’re going to great lengths at the end of the quarter not to disappoint people”.

Hara also called for a change in corporate law such that only long-term shareholders had voting rights, and a careful shift in the concept of stock options – careful, he says, because in some markets like Germany, stock options can be a public good, used as retirement benefits for workers, while in the US they can fuel corporate greed and short-term market hype.

UPBEAT ABOUT HONG KONG

For Hong Kong, Hara is incredibly upbeat about the innovation landscape if the city can show commitment to longer-term investments. What other city in the world, he asked, has five universities in the global top 100? Fundamentally, we have good skills and talents, but we also need small funds to help seed early-stage firms with a long-term view.

“If Hong Kong can do it, Hong Kong will become a model city,” he said.

The last seminar question of the day went to an intellectual property professor, who asked Hara for “one line” to take back to his students.

“It’s very hard,” said Hara. He thought for a moment before enlightenment struck.

“Be kind,” he said, summing up over 40 years of public interest capitalism in two words.

The audience relaxed, applauding. That was something even the hardest-nosed investor could get behind.